by Eldric Vero

September 25, 2023

This is a presentation of the proposed Alberta Pension Plan (APP) based on the August 2023 Report from LifeWorks entitled “Alberta Pension Plan – Analysis of Cost, Benefits, Risks and Considerations”. Here is the link to the report : https://open.alberta.ca/publications/app-analysis-lifeworks-report#summary. This analysis was also spurred-on by The Counter Signal news item “CBC compares Danielle Smith to Dr. Evil for considering liberation of pension plan” (see link: https://thecountersignal.com/cbc-compares-danielle-smith-to-dr-evil-for-considering-liberation-of-pension-plan/).

Panel 1

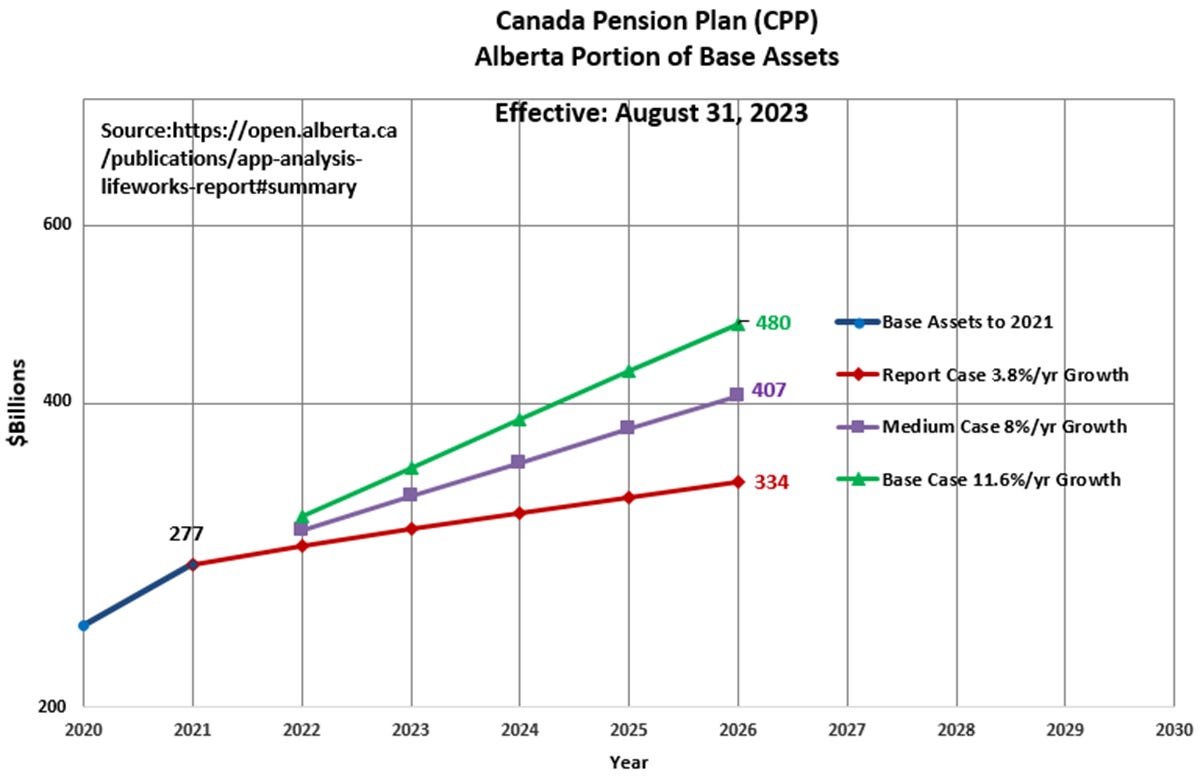

The author has only considered the data presented within the August 2023 Report (the Report) from LifeWorks at this time. The data to create the following graph was extracted from the Report Appendix B in Table B.1.a – Historical Base CPP and Alberta contributions, benefits, operating expenses and rates of return (Base Assets are the blue line). The Base Assets reveal an average annual growth rate of 11.6 percent per year since 1985. The Report forecasts a Base Assets value of $334 billion by 2027 (the red line is a construct of the author to estimate this forecast). The year 2027 was assumed to be the year the Base Assets would be transferred to the proposed APP. The forecast 5 year average annual growth rate is 3.8 percent per year or about one-third of the historical average.

Panel 2

This is a magnified portion of the plot above depicting the Base Assets value to 2021 including the Report Forecast to 2027 and two additional forecast scenarios by the author. Note that the Report Forecast Case value of $334 billion is the equivalent of a “low” or conservative forecast relative to the historical average. The Base Case green line forecasts an 11.6 percent per year growth rate (a continuation of the historical trend) with a Base Asset value of $480 billion by 2027. The Medium Case purple line is a 50 percent best estimate case with an 8 percent per year growth rate to achieve a 2027 Base Asset value of $407 billion.

Panel 3

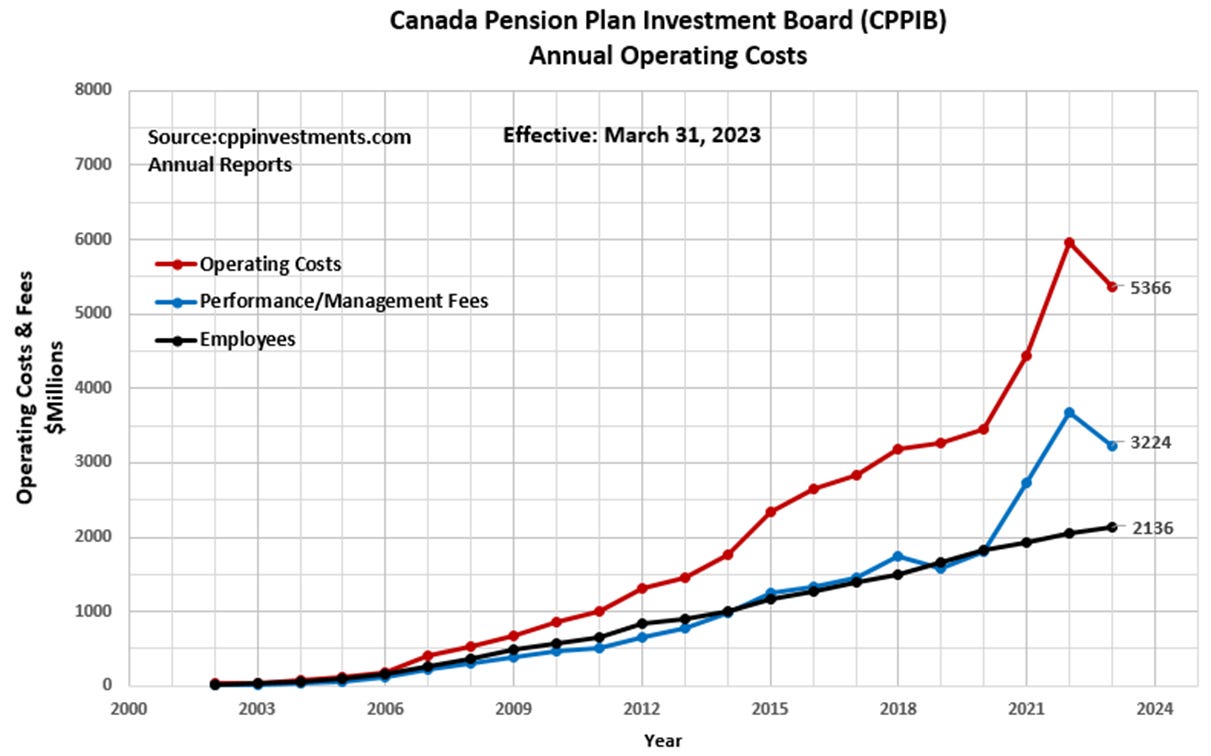

Back on June 24, 2023, the author presented the CotD “Canada Pension Plan Running on Fumes”. This is Panel 5 which presents the CPPIB historical annual operating costs for the past 21 years as per the Annual Reports. The CPPIB staff levels have increased from 26 to 2136 since the year 2002 (an 82-fold increase). Total operating costs have increased from $30 Million to $5.37 Billion (a 176-fold increase) over the same period. To put things in perspective, total operating costs are in the order of $2.6 Million per employee. Note the unusual increase in operating costs since 2020. One must ask the question “is the CPP sustainable under the current model? The main issue is that the proposed APP cannot use the CPPIB operational template as it would result in financial failure for Albertans.

“Prudence is not only the first in rank of the virtues political and moral, but she is the director and regulator, the standard of them all.” Edmund Burke